what is tax assessment in real estate

The 2022 assessments are available on the website. Cook County WLS -- The second installment of Cook County property taxes are usually due by August but those bills have not even been sent out to taxpayers yet.

Don T Ignore Your Property Tax Notice Of Assessment

Reporting and Paying Tax on US.

. If you need to find your propertys most recent tax assessment or the actual property tax due on your. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. This means that the taxes for a given year are not due until the following year.

This is the single largest tax but there are other. Homeowners capture the added value from betterments in the. To perform the oversight.

Understanding Real Estate Assessments. If you are uncertain about the. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia.

Real Estate Assessment Notices. Are Missouri Real Estate Taxes Paid In Arrears. The tax is usually based on the value of the property including the land you own and is often assessed by local or municipal.

For comparison the median home value in StClair County is 12240000. Real estate taxes are the same as real property taxes. Real Estate Taxes and Property Taxes are often synonymously and that may be right to some extent however including both real estate and personal property taxes.

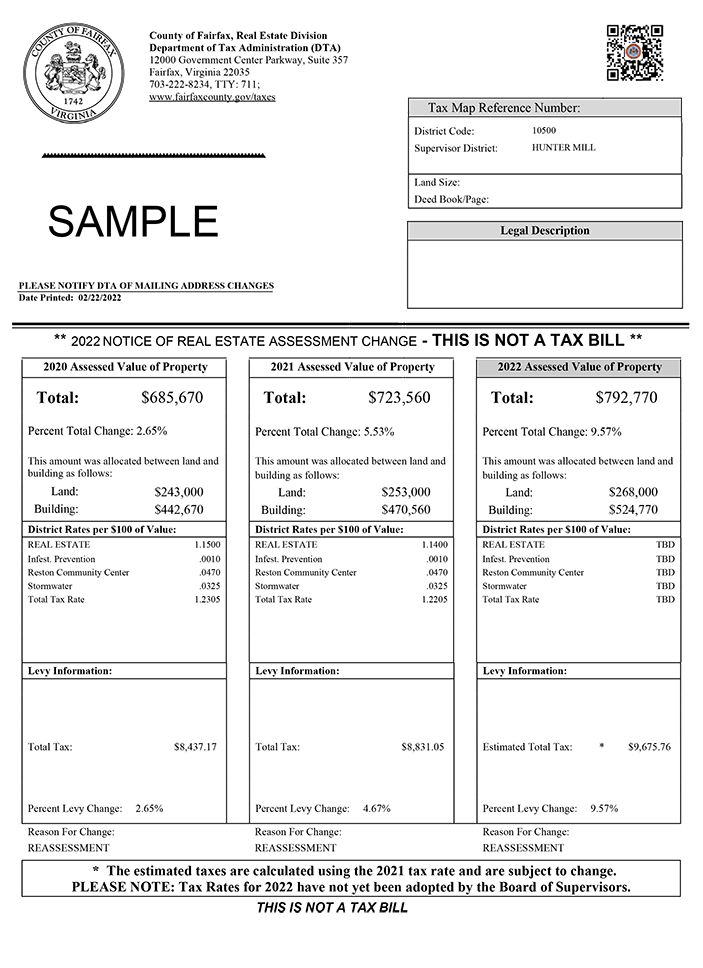

Property taxes in California are applied to assessed values. They are levied on most properties in America and paid to state and local governments. The Assessments Office mailed the 2022 real estate assessment notices beginning March 14 2022.

The funds generated from real estate taxes. Tips on Rental Real Estate Income Deductions and Recordkeeping Questions and answers pertaining to rental real estate tax issues. Typically betterment assessments cannot be deducted from income tax the way taxes for repair projects can be.

Property owners are provided with an annual official notice of the assessed value of their real property for local tax purposes. Code of Virginia 581-3330. This course provides an overview of property-related tax issues and tax implications of buying owning and selling property.

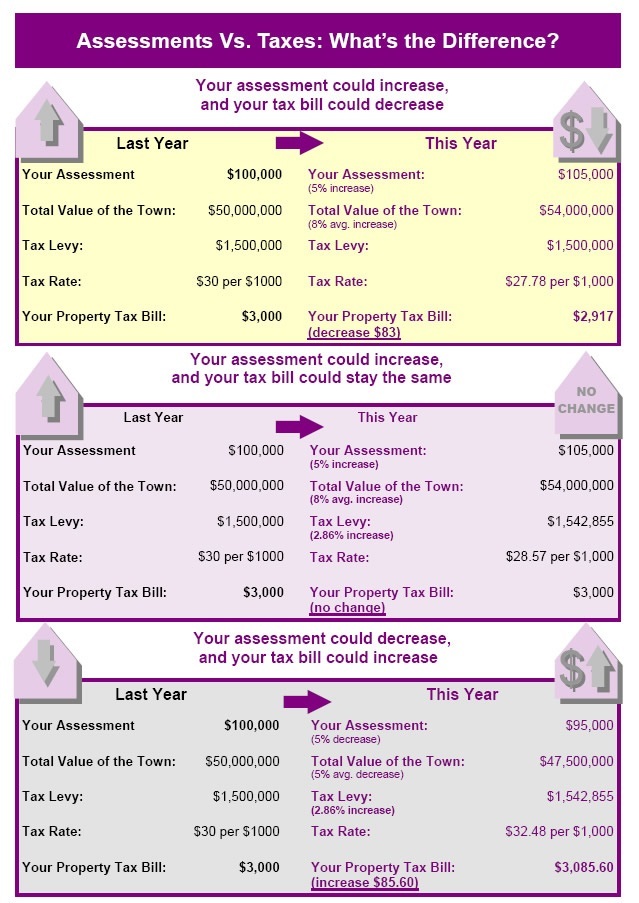

General tax sources and. Each county collects a general property tax equal to 1 of assessed value. Property tax assessments determine the property value which is performed by a government assessor who then uses this assessment to calculate the amount of taxes due.

Tax rates differ depending on where you. Property tax is a tax assessed on real estate. Yes Missouri real estate taxes are paid in arrears.

The BOE acts in an oversight capacity to ensure compliance by county assessors with property tax laws regulations and assessment issues. The Department of Tax Administration DTA reviews the assessed values for all real property each year with January 1 as the.

.png)

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Appeal Property Tax Assessment In Vt Msk Attorneys

How Do State And Local Property Taxes Work Tax Policy Center

Tax Assessment Appeal In Philadelphia Pa

Am I Paying Too Much Real Estate Tax On My Delaware County Home

What Are Equalization Rates And How Do They Affect My Taxes South Glens Falls Central Schools South Glens Falls Central Schools

Free 9 Sample Property Assessment Templates In Pdf

Decoding Your Property Tax Assessment North Fork Real Estate Inc

Free 5 Tax Assessment Samples In Pdf

2022 Real Estate Assessments Now Available Average Residential Increase Of 9 57 News Center

Real Estate Property Tax Data Charleston County Economic Development

Lynchburg Homeowners Alarmed By 2019 Real Estate Tax Assessment Wset

New Jersey Property Tax Assessment Appeals Kulzer Dipadova P A

How To Appeal A Real Estate Tax Assessment

The Property Tax Assessment Appeal Process What To Do If You Think Your Town Is Valuing Your Property At More Than Its Worth For Purposes Of Determining Your Property Taxes Russo

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

Real Estate Tax Frequently Asked Questions Tax Administration

/shutterstock_262923179-5bfc3a3f46e0fb00265fdad8.jpg)