workers comp taxes texas

Texas unlike other states does not require an employer to have workers compensation coverage. Your effective tax rate multiplied by your taxable wages determines the amount of tax you pay.

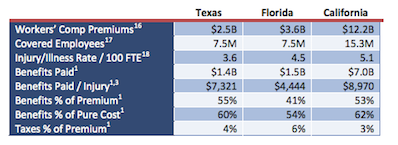

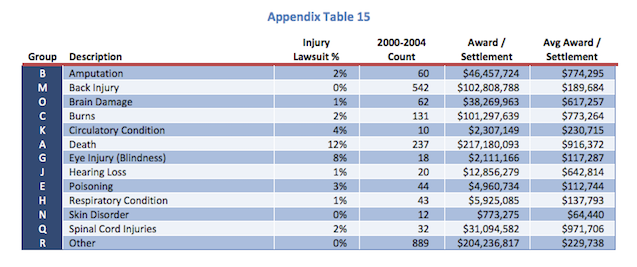

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation

Limitations of Workers Comp Benefits.

. For the most part you will not have to list workers compensation settlement money as income when filing your. In General Workers Comp Settlements Are Not Taxable. Up to 25 cash back Workers comp will also pay up to 10000 for burial expenses.

The Medicare tax rate is 145 of all earnings of both employees and employers. The Texas Department of Insurance is working hard to provide you with information you need to make informed choices about workers compensation insurance. Household employers in Texas are not required to carry a workers compensation insurance policy however we recommend doing so.

Injured workers can receive checks from their settlements even if its one. Insurers licensed by the Texas Department of Insurance and self-insurance groups that write workers compensation insurance coverage must pay this tax. As you can see there are limits to workers comp.

Understanding workers compensation in Texas. Additional Medicare tax needs to be paid depending on the filing. If you received benefits from workers compensation you know that it is designed to reimburse you for expenses from work-related.

Compensation from workers comp earned from on-the-job injuries or illnesses are fully tax-exempt. Refer to 28 TAC Rule 1414 and our publication Insurance Maintenance Tax Rates and Assessments on Premiums. Unemployment Insurance Workers Compensation.

Our agents help TX business owners find the best workers comp insurance. Vary each year as. Your taxable wages are the sum of the wages you pay up to 9000 per employee.

If you have any. We give expert advice about class codes owner exclusions. Vary each year as adopted by the Texas Department of Insurance.

Subscribing to workers compensation insurance puts a limit. Employer costs for unemployment insurance and workers compensation are relatively low in Texas. The cost of workers compensation will vary in Texas.

Texas Payroll Services And Regulations Gusto Resources

Texas Lawmakers Must Stop Eroding Workers Compensation Laws Ut News

Workers Comp Coverage For Employees Vs Independent Contractors New Orleans Citybusiness

Texas Workers Compensation Insurance Laws Forbes Advisor

A Complete Guide To Texas Payroll Taxes

The Texas Tribune Hurting For Work

Is Workers Compensation Taxable In Texas Thompson Law Call 24 7

Comp Rate Weekly Check Amounts In Texas Workers Comp

Workers Comp Waiver Texas Pdf Fill Online Printable Fillable Blank Pdffiller

Texas Workers Compensation Commission Simmons And Fletcher P C

![]()

Texas Nanny Tax Rules Poppins Payroll Poppins Payroll

2020 Guide To Texas Workers Compensation Stats Foresight

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation

Inside A Texas Lawyer S Campaign To Ditch Workers Comp The Texas Tribune

Texas Mutual Insurance Company Austin Chamber Of Commerce

:watermark(cdn.texastribune.org/media/watermarks/2014.png,-0,30,0)/static.texastribune.org/media/images/2014/04/25/WorkersComp-3.jpg)

Worker S Benefits Cut Off Two Decades Later The Texas Tribune

What Is The Bonus Tax Rate For 2022 Hourly Inc

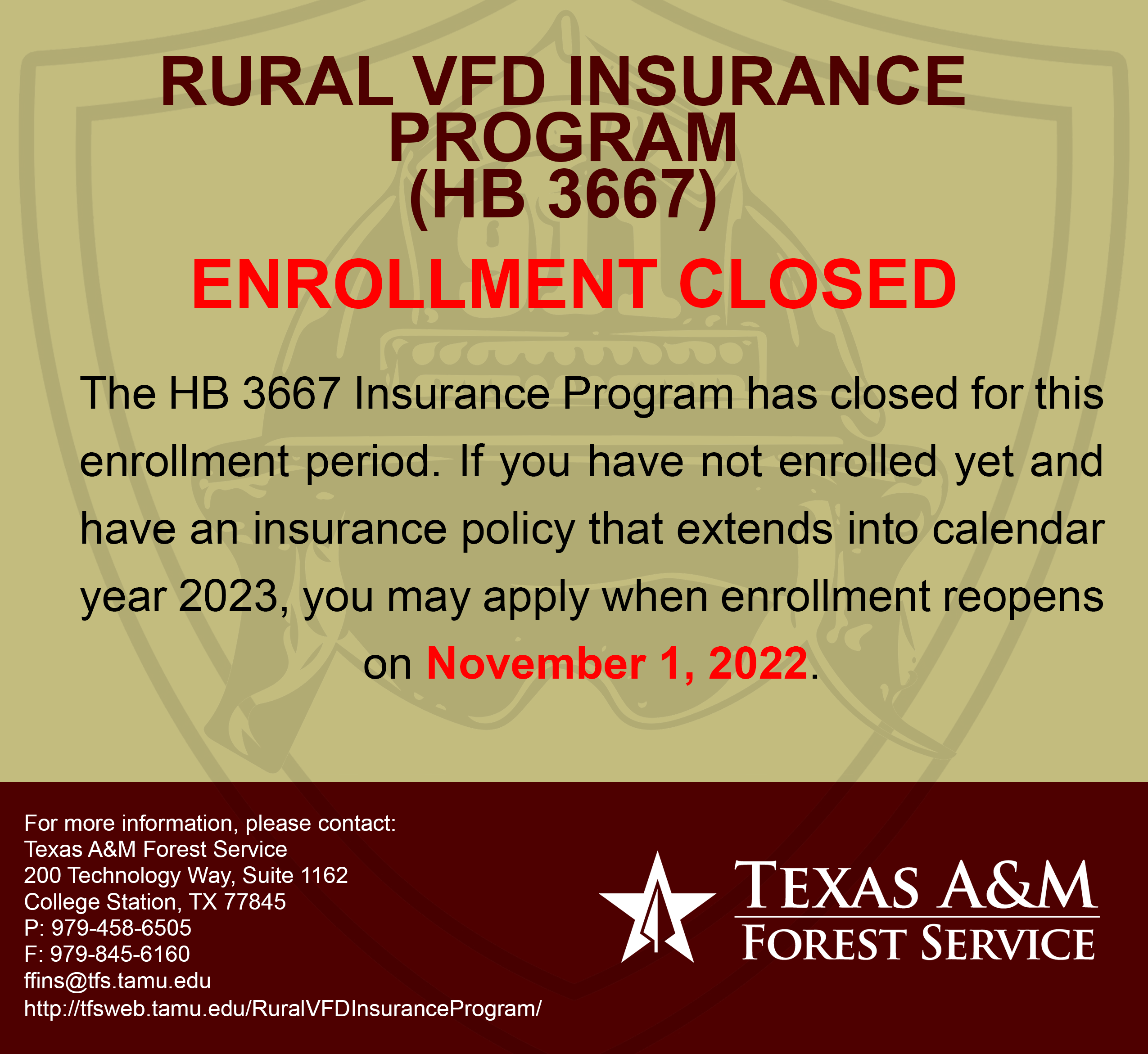

Preparing For Wildfires Rural Volunteer Fire Department Insurance Program Hb 3667 Tfs

Dfw Workers Compensation Lawyers Texas Workers Comp Attorneys